The Unstoppable Rise of Birla Opus

In a stunning market shake-up, Birla Opus, the new entrant in India’s paint industry, has skyrocketed to become the third-largest player by revenue—just six months after its nationwide launch! This unprecedented growth is sending shockwaves through the sector, dominated by giants like Asian Paints, Berger Paints, and Nerolac.

The Aditya Birla Group-backed brand has not only entered the market but has rewritten the rulebook on scaling a paint business in India. Here’s how they did it—and why competitors should be worried.

How Birla Opus Achieved the Impossible

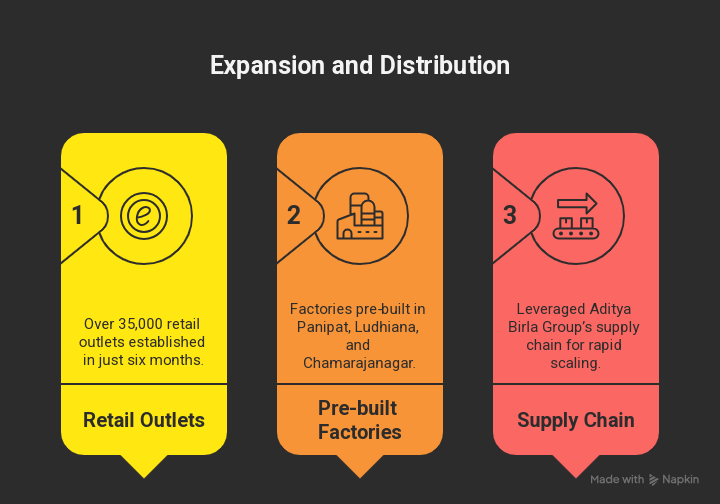

1. Aggressive Expansion & Distribution Power

Birla Opus leveraged the Aditya Birla Group’s vast network, ensuring rapid distribution across 35,000+ retail outlets in record time. Unlike new entrants that struggle with supply chains, Birla Opus pre-installed manufacturing plants in Panipat, Ludhiana, and Chamarajanagar before launch, ensuring seamless supply.

2. Premium Yet Competitive Pricing

While positioning itself as a premium brand, Birla Opus strategically priced products 5-7% lower than market leader Asian Paints. This value-for-money proposition attracted both contractors and premium homeowners.

3. Digital-First Marketing Blitz

Instead of traditional advertising, Birla Opus executed a hyper-targeted digital campaign, focusing on YouTube, Instagram, and influencer collaborations. Their #MyWallsMyStory campaign went viral, engaging DIY painters and young homeowners.

4. Disrupting the Dealer Network

The company offered higher margins to retailers (reportedly 18-20%, vs. the industry standard of 12-15%), incentivizing stores to push Birla Opus over established brands.

Why This is a Game-Changer for the Paint Industry

- Market Share Shake-Up: Asian Paints (50%+ share) and Berger Paints are now facing a serious challenger.

- Rural & Semi-Urban Focus: Birla Opus is aggressively expanding beyond metros, tapping into India’s booming tier-2 and tier-3 demand.

- Innovation Edge: The brand introduced anti-viral, odorless paints—directly appealing to post-pandemic health-conscious buyers.

What’s Next? A Billion-Dollar Paint War?

Analysts predict Birla Opus could cross ₹5,000 crore in revenue within 3 years, putting it neck-and-neck with Berger Paints. The Aditya Birla Group has already announced ₹10,000 crore investments to expand capacity, signaling a long-term domination strategy.

Asian Paints, Berger, and Nerolac are now forced to rethink pricing, dealer incentives, and innovation—or risk losing market share to this new titan.

Final Verdict: Birla Opus is Here to Stay

Birla Opus isn’t just another player—it’s a disruptor rewriting industry rules. For consumers, this means better products, competitive pricing, and more choices. For competitors? The paint war just got bloodier.

🔥 What do you think? Will Birla Opus dethrone Asian Paints? Drop your thoughts in the comments!

Expert guidance – Consult our colour specialists call Paint Sutra:- 9700226666, 8336885588